Russia Warns Atlantis Is â€å“rising Again

Russia is due to make two involvement payments on its dollar bonds on Wed, but it is unclear whether western investors volition actually receive their cash, potentially lining up a uniquely messy government debt default.

Russia'southward first default since 1998* would complete a staggering turnround. Before information technology invaded Ukraine, Russia was considered one of the most creditworthy countries in the earth, with its low debt levels and vast oil and gas exports.

But unprecedented western sanctions aimed at cutting off Russia from the global financial system have sent the country'due south markets into freefall and complicated the procedure of servicing debts.

Will Moscow pay?

Russian federation is scheduled to hand investors a total of $117mn in interest payments on two of its bonds. It has a standard 30-day grace period in which to pay up. If it does non, that would constitute a default.

The finance ministry said on Monday that it had ordered the payments to be made as usual, but added that its ability to do so could exist curbed by western sanctions against the Russian primal bank. Finance minister Anton Siluanov said those sanctions — brought in earlier this month — were bouncing the country into an "artificial default".

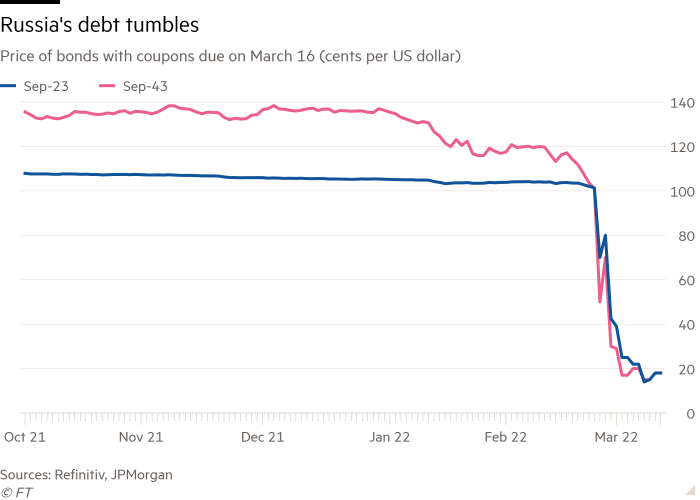

Markets accept already largely priced in a default. Russian federation's foreign bonds are trading at near 20 per cent of their face value — a level that suggests very niggling confidence of being repaid. Credit rating agencies, which up until late February awarded Russia investment-grade status, have slashed it to the very lowest "junk" ratings, with Fitch Ratings maxim a default is "imminent".

In reality, there are multiple official means of beingness declared in default, such as judgments from courts, from rating agencies, or from the finance industry trade body that adjudicates on whether investors can claim on their default insurance.

If Russia pays in roubles, is it still a default?

Siluanov has said it is "absolutely fair" for Russian federation to make payments on its government debt in roubles until sanctions that he claimed accept frozen nearly one-half of the state's $643bn in strange substitution reserves are lifted.

Just payment in the Russian currency would still establish a default in the eyes of most western investors, and non only because of its recent drop in value. Six of Russia's 15 dollar- or euro-denominated bonds exercise contain a "fallback" clause assuasive repayment in roubles, just the two bonds with coupons due on Wednesday are not among them.

In any case, investors in Europe and the US say sanctions — both their own governments' and Moscow's — would in practice make it impossible to set upwardly the Russian depository financial institution accounts necessary to receive rouble payments. Lawyers say that fifty-fifty with the loophole of the culling payment clause, a Russian default is probable and litigation most inevitable.

How much debt is at pale, and who holds it?

Wed'south payments directly concern Russia's $38.5bn of foreign-currency bonds, of which roughly $20bn are owned by overseas investors. But foreigners also hold roughly 20 per cent of Moscow'due south local currency debt — which totalled roughly $200bn before the war sparked a collapse in the value of the rouble and fabricated the bonds virtually untradeable.

The Russian government has already said that a recent coupon payment on these local bonds would not reach strange holders, citing a central bank ban on sending strange currency abroad. This has already been painful for western asset direction groups. More than two dozen take had to freeze funds with significant Russia exposure, while others take sharply written downwards the value of their Russian holdings.

What happens next?

Typically, a default is followed by a period of negotiation betwixt a government and its bondholders to attain an agreement on restructuring the debt. This is ordinarily washed past eventually exchanging the sometime defaulted bonds with new, less onerous ones, either simply worth less, with lower interest payments or with longer repayment schedules — or a combination of all three.

Investors are usually reluctant to head to courtroom and get a formal default declared because that could make the unabridged bond come due and potentially trigger defaults in other bonds where payments take not been missed.

Only a "normal" restructuring seems unlikely in Russia's case. The sanctions are designed to lock the country out of global bond markets and the participation of western investors in any new debt sales is forbidden.

Instead, investors will probably have to sit tight, writing off their Russian bonds and awaiting a de-escalation in the Ukraine conflict that might atomic number 82 to an easing of sanctions. Some may actually desire to quickly vote to demand firsthand repayment and get court judgments from U.s. and Great britain judges that permit them to try to seize overseas Russian avails, to ratchet up pressure on Moscow.

In the meantime, some investors volition be hoping that the failure to make involvement payments triggers a payout on credit-default swaps — insurance-like derivatives used to protect confronting default. The conclusion volition exist fabricated by a finance industry "determinations committee", made upwards of representatives of big banks and asset managers agile in the CDS market. The swaps may not stop up helping bondholders, however, considering the financial sanctions could snarl up the intricate organisation used to settle the contracts.

Volition a default spark a fiscal crisis?

The aftermath of Russian federation'southward last default in 1998 looms large. Moscow's stupor decision to devalue the rouble and renege on its local debt followed on the heels of the Asian financial crisis and sent shockwaves through financial markets, leading to the near-collapse of United states hedge fund Long-Term Capital Management, and its bailout by a consortium of banks.

Even then, Russia kept upwardly payments on its dollar bonds, but defaulted on some Soviet-era international bonds. The last consummate external default came in 1918, when the Bolshevik regime repudiated Tsarist-era debts post-obit the Russian Revolution.

Analysts are relatively confident a rerun of 1998 tin can be avoided. Nikolaos Panigirtzoglou of JPMorgan points out that strange investors and banks have already been cut their exposure to Russian federation since the country'due south 2022 annexation of Crimea, different the mid-1990s when highly leveraged funds were loading up on Russian avails. And so far, the invasion of Ukraine has sparked only modest contagion in other emerging markets, with the far more significant fallout from the crunch being felt in a surge in article prices.

Nonetheless, the history of finance is littered with examples of how unexpected second-lodge effects from widely anticipated events yet concluded up causing broader calamities.

The 30-day grace period ways this "probably isn't however the moment where we see where the full stresses in the financial arrangement might reside . . . However, this is clearly an important story to watch," said Jim Reid, a senior strategist at Deutsche Bank.

*This commodity has been amended since original publication to reverberate the fact that Russia did non default on any of its international Russian Federation-issued "eurobonds" in 1998, but did restructure Soviet-era, dollar-denominated "Brady bonds"

Letter of the alphabet in response to this article:

Liberty to merchandise at odds with despotic ambitions / From Agustin Mackinlay, Lecturer in Finance, La Salle University, Barcelona, Espana

Source: https://www.ft.com/content/9ed033f2-eaa4-4cce-974d-78592a3075af

0 Response to "Russia Warns Atlantis Is â€å“rising Again"

Post a Comment